- VA construction loans are short-term and offered as one-time or two-time close options.

- The builder is no longer required to register and obtain a VA Builder ID, but the home still must meet VA property standards.

- Most lenders, including Veterans United Home Loans, don’t fund the construction phase.

VA construction loans can help qualified Veterans finance the purchase of land and the construction of a brand new home without a down payment.

A true 0% down VA construction loan isn’t common in today's lending climate. Many lenders, including Veterans United, don’t fund the actual construction of the house. Instead, Veterans United can refinance a construction loan into a permanent VA loan after the construction is complete.

Starting with a standard construction loan and then refinancing into the VA loan is a common route among borrowers and lenders.

What is a VA Construction Loan?

A VA construction loan is a short-term loan allowing Veterans to purchase land and build a custom home as their primary residence. There are two types of VA construction loans: the one-time close and the two-time close.

When you get a VA construction loan, whether it involves two closings or is bundled into one, the lender or construction loan typically disburses funds to the builder in stages (called draws) as construction progresses. Once the house is finished, you transition to the permanent VA loan.

- For a VA one-time close construction loan, the construction and permanent financing are handled with a single loan at closing before construction commences. The loan automatically converts to a permanent VA mortgage after construction is complete.

- In a two-closing setup, there are two separate closings (and associated closing costs) — one for the VA construction financing and one for the permanent mortgage. In this setup, the second closing finalizes the VA loan, which is used to pay off the short-term construction loan.

Keep in mind, the VA itself doesn’t offer construction loans. A VA construction loan is a loan that private lenders make, and the VA insures the loan.

For one-time close loans, if you’re planning to use a VA refinance later on, the VA’s seasoning requirement doesn’t start until the loan converts to permanent financing. From there, you’ll need to wait at least 210 days from the due date of your first mortgage payment and make six consecutive, on-time monthly payments before you're eligible to refinance.

VA Construction Loan Requirements

You’ll need to meet all the standard VA loan eligibility requirements to qualify for a VA new construction loan, as well as some additional ones you wouldn’t run into in the typical VA loan home purchase.

VA loan new construction requirements include:

- Finding a licensed and insured builder that fits your needs (a VA Builder ID is no longer required for new or proposed construction)

- Submitting a complete set of construction plans to your lender when applying

- Appraising the home construction plans

- Providing any additional documentation your lender may require — usually, this will include the materials involved in the construction

VA Construction Loan Uses

Veterans can use a VA construction loan to build a single-family home on land they own or plan to purchase. However, the VA has restrictions about using the VA loan to purchase land. Veterans can't buy land with a VA loan unless they immediately begin construction after purchase.

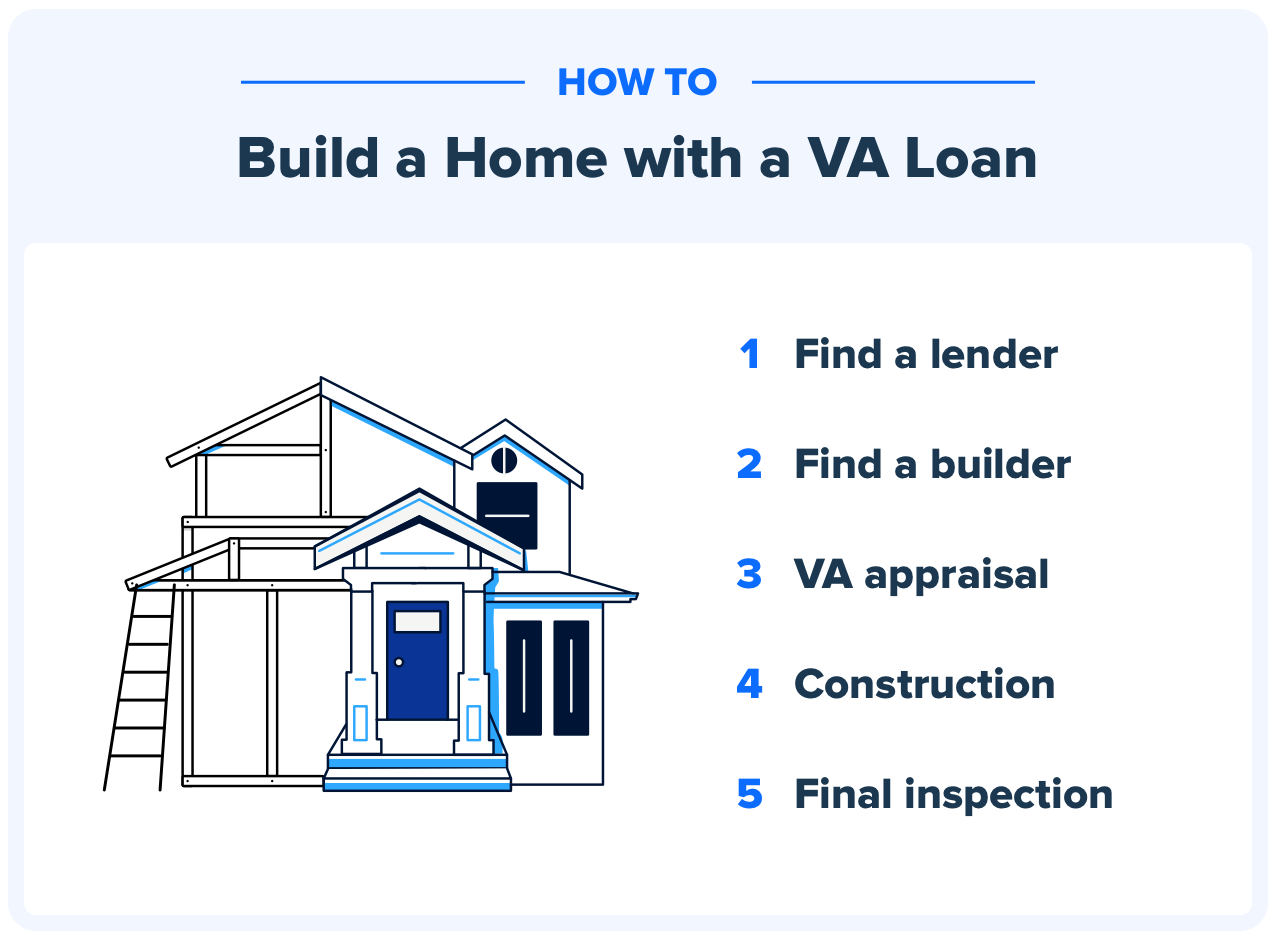

What is the VA Construction Loan Process?

Every homebuyer’s situation looks different, depending in part on the lender they’re working with, the home builder and a host of other factors.

Generally, the process follows along these lines:

Step 1: Find a Lender

This first step can prove challenging. Many VA lenders do not offer financing for new construction. We’ll explore other ways to use your VA loan benefit to build a home in the next section.

Credit score requirements, interest rates and other variables can and often will vary among lenders. If you find a trustworthy lender offering these loans, then you’ll work with them to close the loan before construction starts. That means providing the same kind of income, employment and financial information you would for a traditional VA purchase loan.

Step 2: Find a Builder

The VA no longer requires builders to register for a VA Builder ID. However, it’s still important to choose a reputable, experienced builder who’s familiar with VA loan requirements for new construction. If you need help finding a builder, the VA maintains a list of its registered home builders on its Loan Guaranty Hub.

Your builder will need to provide the construction plans and other documentation to your lender for approval. To avoid delays, look for builders who have experience working with VA loans or are open to collaborating with VA-approved lenders.

Step 3: VA Appraisal

The lender will order a VA appraisal based on the new build plans and specifications. Soon after, the VA issues the formal Notice of Value listing the home’s fair market value. Lenders will lend the lesser of the home’s acquisition costs and its fair market value. Once this key step is complete and the proposed home meets VA guidelines, your loan can move to closing.

Step 4: Construction

With a true VA construction loan, Veterans close on the loan before the build begins. The lender then makes draws to a builder to cover the stages of new home construction. The builder pays for the closing costs and interest during closing, but they can include these costs in their agreement with the borrower to build.

Step 5: Final Inspection

The VA requires a final inspection when the home is complete. The original appraiser typically conducts the final inspection whenever possible. This inspection ensures the home still meets VA's broad property condition guidelines (Minimum Property Requirements) and was built to the correct plans and specs.

What if You Can't Find a VA Construction Loan?

While the VA insures a portion of each loan, it's up to individual VA lenders to determine what kind of loans they'll issue. The level of risk in new construction often causes many VA lenders to shy away.

Like many other lenders, Veterans United does not make VA construction loans to build new homes.

An alternative to getting a VA construction loan is getting a construction loan from a builder or a local lender and then refinancing that into a permanent VA loan.

This approach is something we help Veterans with every month. Here’s what you need to know.

Another Option: Starting With Standard Construction and Refinancing Into a VA Loan

Veterans unable to find a lender willing to finance a true VA construction loan can apply for a traditional construction loan and transition to a VA loan after closing.

Getting a traditional construction loan often requires a down payment. However, it may be possible to recoup the down payment in some cases.

When searching for a construction loan, it can pay to shop around. Talk with multiple builders and financial institutions and compare down payment requirements, closing cost estimates and more.

Some builders may have programs or deals, especially for Veterans and military families. Do your homework and make sure you're working with a legitimate builder with a track record of success and satisfied homeowners.

Veterans and military members who own the land they want to build on may be able to use any equity they have toward down payment requirements for construction financing.

Veterans who don't already own land can often include purchasing it in their overall construction loan.

It's important to understand that construction loans are short-term loans. That means Veterans and military members must start working on the permanent financing as early as possible. Ideally, you should communicate with a VA lender from the very beginning, so you’re both prepared to switch to permanent financing once the construction is complete.

Permanent VA Financing for Construction Loans

Lenders can take a couple of different approaches to turn that short-term construction loan into a permanent VA loan. One is to issue a VA purchase loan, and the other is to make a VA Cash-Out refinance loan. Guidelines and policies on this can vary by lender.

From an underwriting perspective, there's little difference between a VA purchase and a VA Cash-Out refinance. In both instances, Veterans and military members hoping to turn their construction loan into a permanent VA mortgage will need to meet the same underwriting guidelines as Veterans purchasing an existing home. This includes meeting requirements for credit score, debt-to-income ratio, residual income and more.

Additionally, similar to a VA construction loan, the home must be built by a licensed and insured builder who meets your lender's requirements. While it’s possible for Veterans to build the home themselves in some cases, most lenders typically require professional oversight. Builders are also often required to provide a one-year warranty on the home.

Lining up a construction loan is a critical step, but you'll need to turn that short-term loan into a long-term mortgage once the home is built. That's not something you want to wait to explore.

New Construction Purchase vs. Cash-Out Refinance

The big difference between VA purchase and VA Cash-Out refinance loans is your ability to get cash back at closing.

With a VA purchase loan, lenders will lend the lesser of the home's appraised value and the total payoff for the home's construction (and the land loan if that amount isn't included in the construction loan).

On a VA Cash-Out refinance, qualified buyers may be able to borrow up to 100% of the home's appraised value. That means Veterans and military members may be able to get cash back at closing from the home's equity, which could help defray the upfront cost of a down payment or other cash outlays.

For example, let's say you put down 10% to secure a $300,000 construction loan covering the acquisition of the land and construction of the new home. Subtract the down payment ($30,000), and you're left needing to borrow $270,000 to repay the construction loan.

If the VA appraisal ultimately determines the home's value is $300,000, you might be able to borrow that amount and get back in cash the difference between the appraised value and what you owe ($30,000 in this example).

Guidelines on loan-to-value ratio and other requirements can vary by lender.

Generally, the borrower needs to hold title to the land on which the home is built in order to be eligible for a refinance. Otherwise, Veterans United would treat it as a purchase loan.

Some buyers may jump at this cash-back opportunity, while others prefer to keep building equity and start with the smaller loan balance. Every buyer's situation is different.

Facing Low Inventory, Some Veterans Consider Building

With housing inventory at its lowest level in nearly 25 years, some Veterans and service members are looking at new construction as the ideal way to avoid the low-inventory issue. This issue is still a large barrier for buyers, with 21% citing a lack of housing inventory as a barrier holding them back, according to a recent national survey of Veterans and service members with near-term homebuying plans.

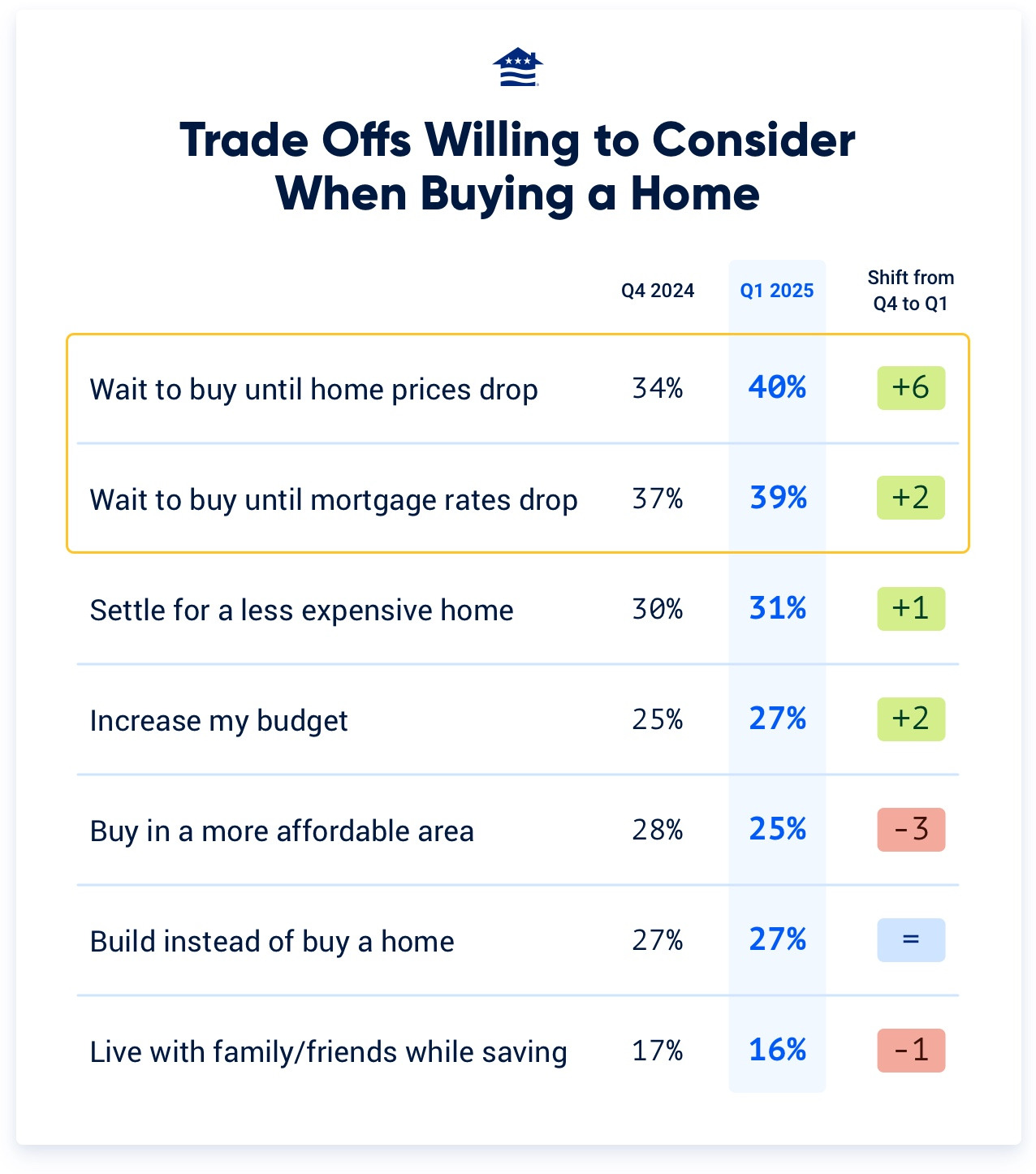

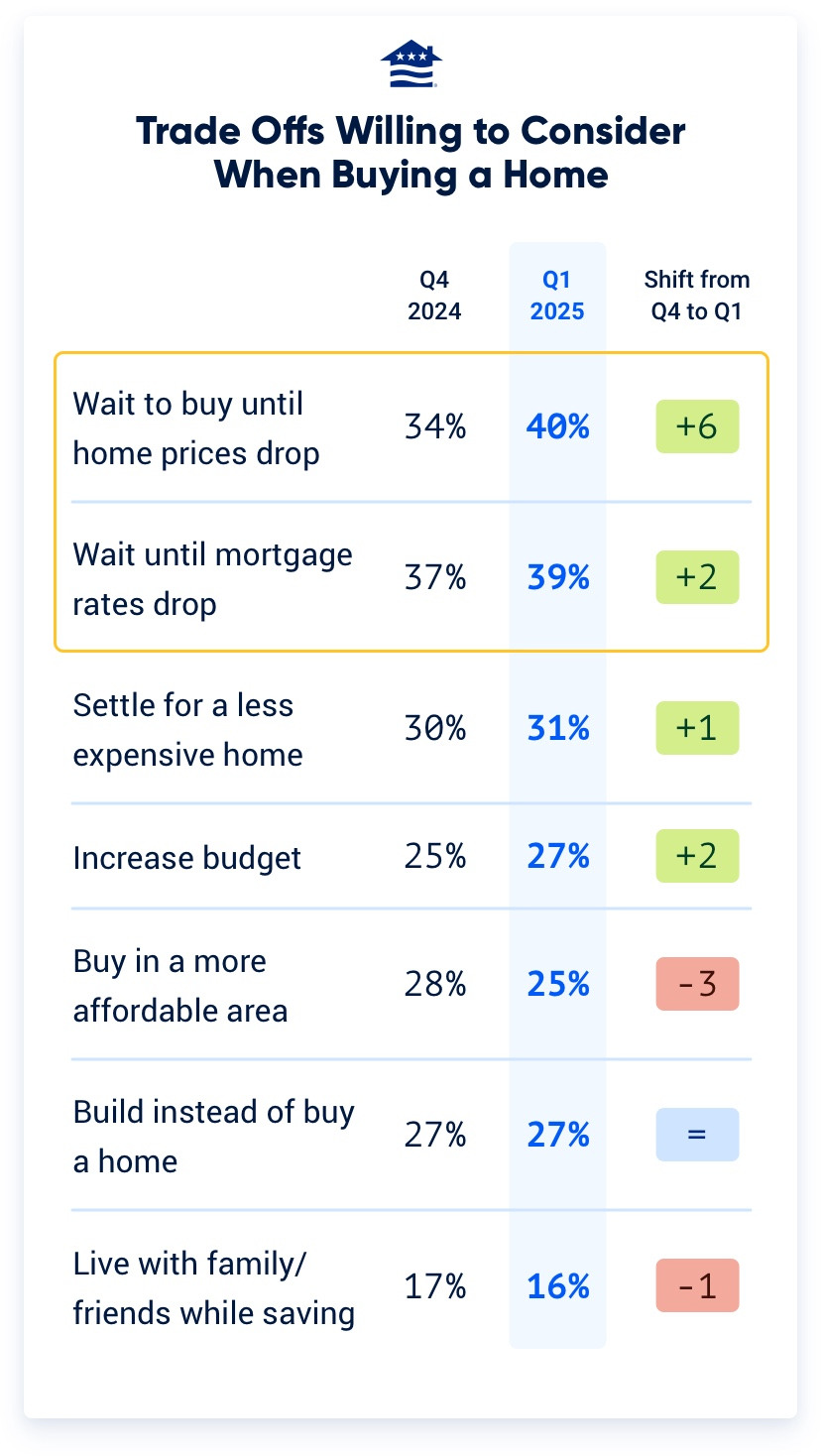

Veterans cited high interest rates and high home prices as the largest barriers to buying a home in Q1 2025, with those figures increasing by two and six points from Q4 2024, respectively.

Building a new home is one of the top six trade-offs Veterans and service members are willing to make given the inventory shortage, according to Veterans United Home Loans’ most recent Veteran Homebuyer Report, a quarterly national survey of Veterans, service members and civilians who intend to buy homes in the next three years.

Here’s a look at the top compromises Veterans are willing to make:

More Veterans are trying to side-step the inventory issue entirely and use their hard-earned home loan benefit to build a new home. To be sure, it isn’t always an easy road.

It is absolutely possible to use your VA loan benefits for new construction. But the process isn't always simple or straightforward, and some buyers may need money for a down payment to get things moving.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jun 20, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Updated data figures and copy to reflect the 2025 Veteran Homebuyer Report.

Jun 19, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Added expert insight about VA construction loans.

Apr 3, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Updated to reflect that VA Builder IDs are no longer required.

Dec 12, 2024

Written ByChris Birk

Reviewed ByDon Wilson

Added additional content to fully explain the one-time close and two-closing VA constructions loans and enhance content for the construction-to-refinance alternative. Added an updated Q3 2024 data analysis of homebuyers facing a low-inventory market and how it's relevant to the construction loan. Fact-checked and reviewed by underwriter Don Wilson.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.